For consumers and organizations alike, fraud is a growing cause for concern across all industries. The stakes are even higher, however, in industries like healthcare, which has suffered the highest number of fraud attacks of any sector over the past few years.

The other significant concern in healthcare is account takeovers, where fraudsters obtain a victim’s account information and impersonate them to get free services.

Compared to other frauds, healthcare and medical frauds can be particularly dangerous, because they:

- Have a high transactional value: Compared to stolen PII or credit information, medical records have a very high transactional value in black markets – sometimes up to 60 times the price of other stolen data. This is because of the sheer quantity of data (name, birthdate, social security number, insurance details, etc.) about a particular victim that is available through these records.

- Can go undetected for a long time: In the financial services industry, advanced technology has been put in place to help mitigate the risk of attacks that has long plagued the industry. In healthcare, however, tracking and disputing medical record theft is much more difficult – meaning frauds can go undetected for a very long time, even years.

Current authentication techniques are simply not enough

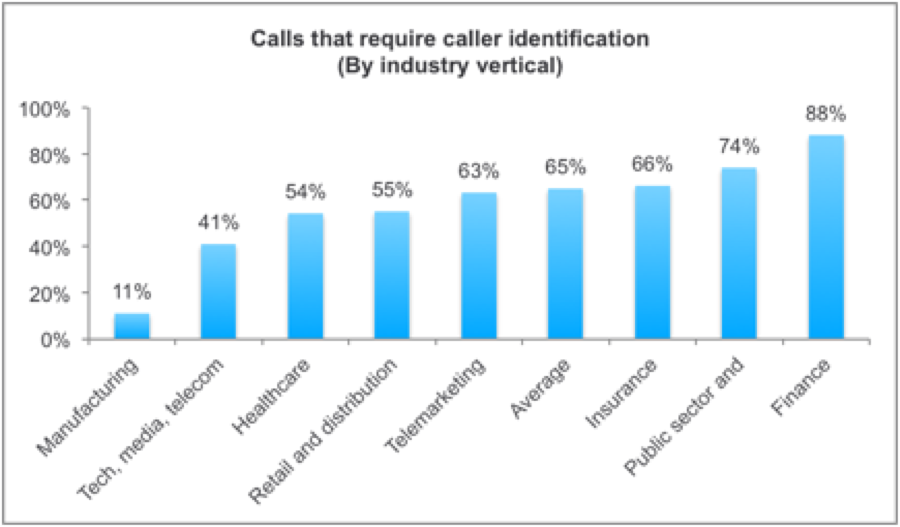

One reason why such attacks have been able to occur is the vulnerability of current account protection and authentication methods. And since approximately 54% of healthcare calls require caller identification, this is a significant issue for most organizations.

Consumers, however, are tired of maintaining multiple usernames and passwords, and often find themselves trying to remember the answer to obscure questions, like “what is the name of your first grade teacher?” or “which street did you live on when you were a child?.”

85% consumers are frustrated with Knowledge Based Authentications (KBA) such as PINs, passwords and personal information. What’s worse is that over 15% of knowledge-based questions can be answered or guessed correctly by random strangers, according to Opus Research.

Voice biometrics can help both healthcare providers and consumers

Each year, U.S. customer service call centers spend $12.4 billion verifying the caller’s identity. Out of all the calls that require authentication, over 80% then go to live agents, which can be costly for organizations.

Voice biometrics utilizes voice patterns to produce unique identification for every individual – called voiceprints – that use more than 100 physical and behavioral factors. This provides the most convenient and secure way of authenticating and verifying callers, physicians, patients, members and partners, using what they always have with them – their own voice!

For healthcare providers – insurance companies, pharmacies, and partners, voice biometrics can offer:

- Cost reduction: by reducing the agent cost associated with ID&V by 70-80%

- Fraud protection: by preventing fraudulent attacks, account takeovers & social engineering and securing access to health records to comply with regulations such as HIPAA and the Data Protection Act

- Improved CSAT and brand loyalty: by showing dedication to protect consumers ID and data, and providing faster, better customer experience

For end consumers, voice biometrics provides:

- Convenience: after the initial enrollment, consumers speak naturally to authenticate

- Ease of use: consumers do not need to remember cumbersome PINs and passwords

- Privacy: customers do not need to share sensitive PII or PHI information in public while authenticating themselves